Public-Private Partnership (PPP) can be broadly defined as a contractual agreement between the Government and a private firm targeted towards financing, designing, implementing and operating infrastructure facilities and services that were traditionally provided by the public sector. It embodies optimal risk allocation between the parties – minimizing cost while realizing project developmental objectives. Thus, the project is to be structured in such a way that the private sector gets a reasonable rate of return on its investment.

PPP offers monetary and non-monetary advantages for the public sector. It addresses the limited funding resources for local infrastructure or development projects of the public sector thereby allowing the allocation of public funds for other local priorities. It is a mechanism to distribute project risks to both public and private sector. PPP is geared for both sectors to gain improved efficiency and project implementation processes in delivering services to the public. Most importantly, PPP emphasizes Value for Money (VfM) – focusing on reduced costs, better risk allocation, faster implementation, improved services and possible generation of additional revenue.

Elements of Public-Private Partnership

- Strategic mode of procurement

- A contractual agreement between the public sector and the private sector

- Shared risks and resources

- Value for Money (VfM)

- Outcome orientation

- Acceleration of infrastructure provision and faster implementation

Generally, there are two common forms of PPP structure: availability and concession-based PPPs. The two forms could be distinguished from each other based on what the public or private parties assume within the partnership, e.g. rights, obligations, and risks.

- Availability PPP

A form of PPP wherein the public authority contracts with a private sector entity to provide a public good, service or product at a constant capacity to the implementing agency (IA) for a given fee (capacity fee) and a separate charge for usage of the public good, product or service (usage fee). Fees or tariffs are regulated by contract to provide for recovery of debt service, fixed costs of operation and a return on equity.While there are no usage fees in this project, an example is the PPP for School Infrastructure Project (PSIP) Phase I wherein the private sector is responsible for making available classrooms (consisting of design, financing, construction and maintenance) for a contract fee with the Department of Education (DepEd).

- Concession PPP

A form of PPP wherein the government grants the private sector the right to build, operate and charge public users of the public good, infrastructure or service, a fee or tariff which is regulated by public regulators and the concession contract. Tariffs are structured to provide for recovery of debt service, fixed costs of operation, and return on equity.An example of a concession PPP is the Ninoy Aquino International Airport (NAIA) Expressway (Phase II) wherein the Department of Public Works and Highways (DPWH) granted the private sector the right to build and operate the expressway. Under the contract, the private sector was given the right to collect a toll (user charge) from the users of the expressway.

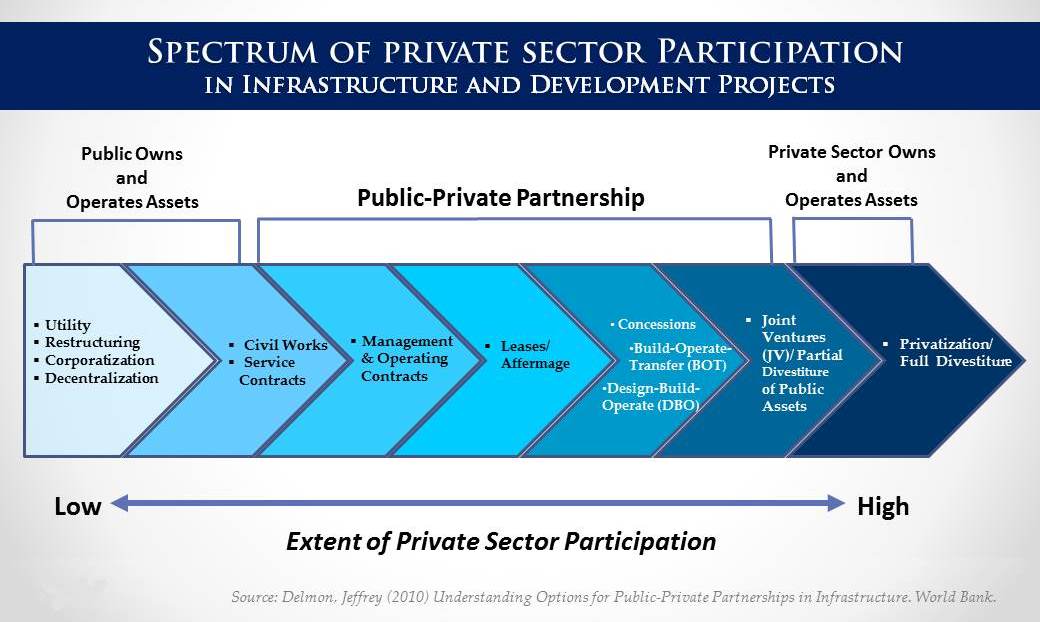

There are various PPP contractual arrangements reflecting how risks are shared and the roles between the government and the private proponent. Build-operate-and-transfer (BOT) projects and its other variants can be structured as either a concession or availability agreement.

Partnership between the government and private sector for infrastructure and development projects can be made possible through a broad spectrum of modalities. The following are the contractual arrangements which may be undertaken under the amended Philippine BOT Law and its Revised Implementing Rules and Regulation:

- Build-and-transfer (BT)

- Build-lease-and-transfer (BLT)

- Build-operate-and-transfer (BOT)

- Build-own-and-operate (BOO)

- Build-transfer-and-operate (BTO)

- Contract-add-and-operate (CAO)

- Develop-operate-and-transfer (DOT)

- Rehabilitate-operate-and-transfer (ROT)

- Rehabilitate-own-and-operate (ROO)

The enumeration of contractual arrangements in the BOT Law is not exhaustive. Other forms of contractual arrangements may qualify as a PPP under the BOT Law, provided that such arrangement is approved by the President. Other contractual modes recognized as PPPs are concession and management contracts.

The Revised IRR of the BOT Law enumerates the list of activities which may be undertaken under any of the recognized and valid BOT contractual arrangements (PPP modalities). These include, among others:

- Highways, including expressways, roads, bridges, interchanges, tunnels, and related facilities;

- Railways or rail-based projects that may or may not be packaged with commercial development opportunities;

- Non-rail based mass transit facilities, navigable inland waterways and related facilities;

- Port infrastructures like piers, wharves, quays, storage, handling, ferry services and related facilities;

- Airports, air navigation, and related facilities;

- Power generation, transmission, sub-transmission, distribution, and related facilities;

- Telecommunications, backbone network, terrestrial and satellite facilities and related service facilities;

- Information technology (IT) and data base infrastructure, including modernization of IT, geo-spatial resource mapping and cadastral survey for resource accounting and planning;

- Irrigation and related facilities;

- Water supply, sewerage, drainage, and related facilities;

- Education and health infrastructure;

- Land reclamation, dredging and other related development facilities;

- Industrial and tourism estates or townships, including ecotourism projects such as terrestrial and coastal/marine nature parks, among others and related infrastructure facilities and utilities;

- Government buildings, housing projects;

- Markets, slaughterhouses, and related facilities;

- Warehouses and post-harvest facilities;

- Public fishports and fishponds, including storage and processing facilities;

- Environmental and solid waste management related facilities such as, but not limited to, collection equipment, composting plants, landfill and tidal barriers, among others; and

- Climate change mitigation and adaptation infrastructure projects and related facilities.

In general, governments tap public-private partnership (PPP) for the following reasons:

- PPPs encourage the injection of private sector capital.

- National budget and Official Development Assistance (ODA) are limited and are subject to government prioritization. Private sector funding, on the other hand, is readily available. It may be tapped to augment ODA funds and the government budget to implement critical government projects.

-

- In the case of big ticket infrastructure projects, PPPs utilize the financial capital of the private sector. Through it, project construction and service delivery is accelerated. For example, the NAIA Expressway Phase II project will be financed through private sector funding. On top of this, the government has received an upfront payment of 11 billion pesos even before the actual project construction.

- PPPs make projects affordable.

- Government spending will be less if the project is undertaken as a PPP, since the private sector funds their share of the project (including operation and maintenance) during the duration of the concession. PPP projects consider the whole of life costing approach (whole lifecycle costing) which ultimately lowers capital and operating costs.

-

- All PPP projects undergo a competitive, transparent bidding. PPP project proponents usually provide the most cost-effective capital goods necessary for the project.

- PPPs deliver value for money.

- Value for money (VfM) is achieved when the government obtains the maximum benefit from the goods and services it both acquires and provides. It is the best available outcome after taking into account all the benefits, costs, and risks over the entire project life, which may not necessarily be the lowest cost or price.

-

- For the PPP for School Infrastructure Project (PSIP) Phase 1, the PPP scheme was identified as the most optimal financing option available for the government to address the current classroom backlog in the country. Under this scheme, the government will be able to deliver the needed classrooms in the shortest time possible.

- In PPPs, each risk is allocated to the party who can best manage or absorb it.

- In PPPs, risks are assumed by the party that is best able to manage and assume the consequences of the risk involved.

-

- PPPs enable the government to take on fewer risks due to shared risk allocation. Generally, the private sector takes on the project’s life cycle cost risk, while the government assumes site risks, legislative and government policy risks, among others.

- PPPs force the public sector to focus on outputs and benefits from the start.

- Project preparation activities are more rigorous in public-private partnerships. This ensures that the project is highly bankable and can stand public scrutiny. Better project preparation and execution will result in adherence to project design within the agreed timelines.

-

- In PPPs, the government focuses on providing quality infrastructure and services by setting each project’s minimum performance standards and specifications (MPSS).

- With PPPs, the quality of service has to be maintained for the entire duration of the cooperation period.

- In PPPs, project execution will be more rigorous as project ownership belongs to the project proponents. The public sector only pays when services are delivered satisfactorily.

-

- During the implementation stage, an independent consultant is hired to ensure that both public and private parties adhere to the terms of the contract/ concession agreement. This is true in the case of projects presently undergoing construction—the PSIP Phase 1 and the Daang Hari- SLEX Link Road project.

- PPPs encourage innovation.

- PPPs maximize the use of private sector skills. It utilizes higher levels of private sector efficiency, specialization, and technology.

-

- In the case of the PSIP and the Daang Hari-SLEX Link Road projects, private proponents were given flexibility in coming up with the project design that is most efficient, taking into consideration the MPSS set by the government.

Solicited proposal

A solicited proposal refers to projects identified by the implementing agency (IA) from the list of their priority projects.

In a solicited proposal, the IA formally solicits the submission of bids from the public. The solicitation is done through the publication of an invitation for interested bidders to submit bids, and selection of the private proponent is done through a public competitive process.

Unsolicited proposal

In an unsolicited proposal, the private sector project proponent submits a project proposal to an IA without a formal solicitation from the government. An unsolicited proposal may be accepted for consideration and evaluation by the IA, provided it complies with the following conditions:

- It involves a new concept or technology and/or it is not part of the list of priority projects in the Philippine Investment Program (PIP) [Medium Term Public Investment Program, Comprehensive and Integrated Infrastructure Program (CIIP)] and the Provincial/Local Investment Plans;

- It does not include a Direct Government Guarantee, Equity or Subsidy;

- It has to go to ICC for the determination of reasonable Financial Internal Rate of Return (FIRR) and approval to negotiate with the Original Proponent; and

- After successful negotiation, proceed to publication and request for competitive proposals according to Swiss Challenge Rules.

What are PPPs?

Public-Private Partnerships (PPPs) are contractual arrangements entered into by the government with the private sector. Under a PPP scheme, the private sector can build, operate and maintain public infrastructure facilities and provide services traditionally delivered by government. Examples of these are roads, airports, bridges, hospitals, schools, prisons, railways, and water and sanitation projects.

What are the government’s legal basis for entering into PPPS?

Republic Act (RA) 6957, as amended by RA 7718 (commonly known as the BOT Law), and its Implementing Rules and Regulations (IRR), the 2013 NEDA JV Guidelines, Executive Order No. 423 s. 2005, and the Local Government PPP Code/JV Ordinance.

Who can enter into PPP?

Government implementing agencies (IAs) can enter into PPP. BOT Law and its IRR defines an “Agency” referring to any department, bureau, office commission, authority or agency of the national government, including Government-Owned and/or –Controlled Corporations (GOCCs), Government Financial institutions (GFIs), and State Universities and Colleges (SUCs) authorized by law or their respective charters to contract for or undertake Infrastructure or Development Projects.

Who owns the PPP projects?

In a PPP scheme, the government owns the PPP projects. Even as the private partners build, operate and maintain the project, ownership remains with the government.

What types of projects can government undertake as a PPP project?

There are multiple infrastructure and development projects that are eligible as PPP. These include highways/ roads, railroads/ railways, ports, airports, transport systems, ICT systems/ facilities, agriculture, canals/ dams/ irrigation, water supply, land reclamation, solid waste management, tourism facilities, education, health facilities, industrial/ tourism estates, public markets/ warehouses/ slaughterhouses, housing, government buildings, and climate change mitigation/ adaptation infrastructure project, among others.

Who may qualify as bidders of these PPP projects?

According to Section 5.1 of the BOT Law IRR , any individual, partnership, corporation, firm, whether local or foreign, including consortia of foreign or local and foreign firms can participate or apply for pre-qualification or simultaneous qualification for ppp projects. However, if the project involves the operation of a public utility, the operator must be at least 60% Filipino owned.